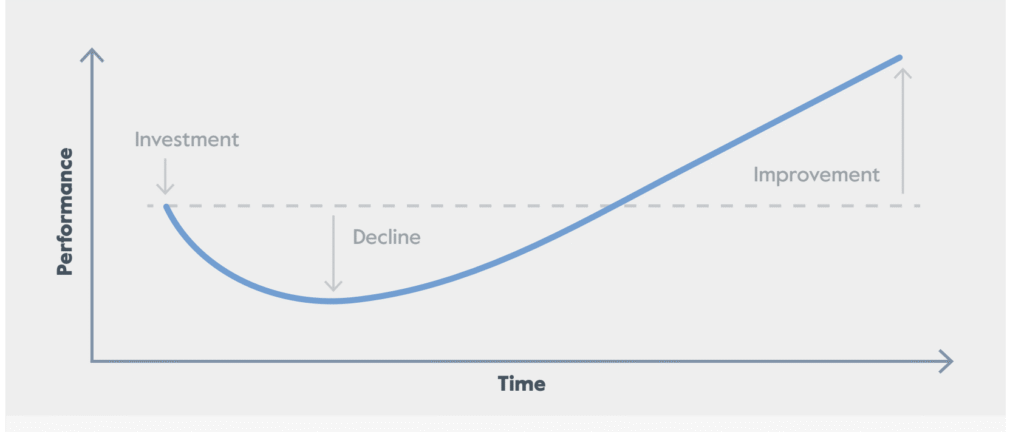

Any VC or PE investor will know the J-Curve well. It is a representation of a fund’s returns, first swooping down to the right into negative before lifting up into positive returns.

Why does it go negative?

Fees

At the beginning of a fund’s life the fund invests or pays out money. Capital moves out. The investors (LPs) sent their cheques, and now the fund starts identifying businesses to invest in, and then allocates the capital. That is money out. Fees also contribute to the negative dip at the initial stage of the fund. The fund managers still charge LPs for work, despite having produced no returns yet. Other fees also must be paid to complete deals, such as transaction, legal and diligence fees. These sink a fund’s returns further.

Valuation

It’s common practice in a fund to hold early investments at cost, and not raise the valuation of the firm until an exit or another round. That could be a couple years ahead. VCs typically hold a company longer than PE, which averages 10-12 years. I think 10 years is a good rule of thumb for a fund’s lifespan though, and I think it’s not uncommon for must funds to only start realizing returns 5-7 years in.

Mitigating the J-Curve

Investors think its a good idea to avoid losses, even if they are temporary. That means smart people have tried to come up with various methods of avoiding the negative dip in the J-Curve. The easiest way to do that is invest later in a fund’s life, after it starts realizing improvements. This is called a secondary. Because capital from secondaries is deployed into funds that are already partially or fully invested, much of the early drag from management fees and unseasoned assets has already occurred. Secondary investors gain exposure to more mature portfolios, with visibility into underlying companies and the potential for near-term distributions. As a result, secondaries may serve as a valuable tool for managing liquidity and mitigating the early cash flow demands of primary fund commitments. (Carlyle)

Wrapping Up

Investors require patience to manage the psychological weight of carrying losses for several years. As the J-Curve steepens, your risk tolerance drops, and each new deal you see is weighed against the losses you hold under your belt. Until those losses start turning around, it’s another burden you have to carry in your investment ranking. I believe it’s at times like these data centric investment decisions really help. The more you can offload your bias, the better.

Further Reading

Top Secondary Deals of 2024

https://www.secondariesinvestor.com/top-five-secondaries-deals-of-2024

The Brief Case on J-Curves in Private Equity

Largest Secondary Funds in the Market

https://pitchbook.com/news/articles/largest-secondary-funds-in-the-market-2024