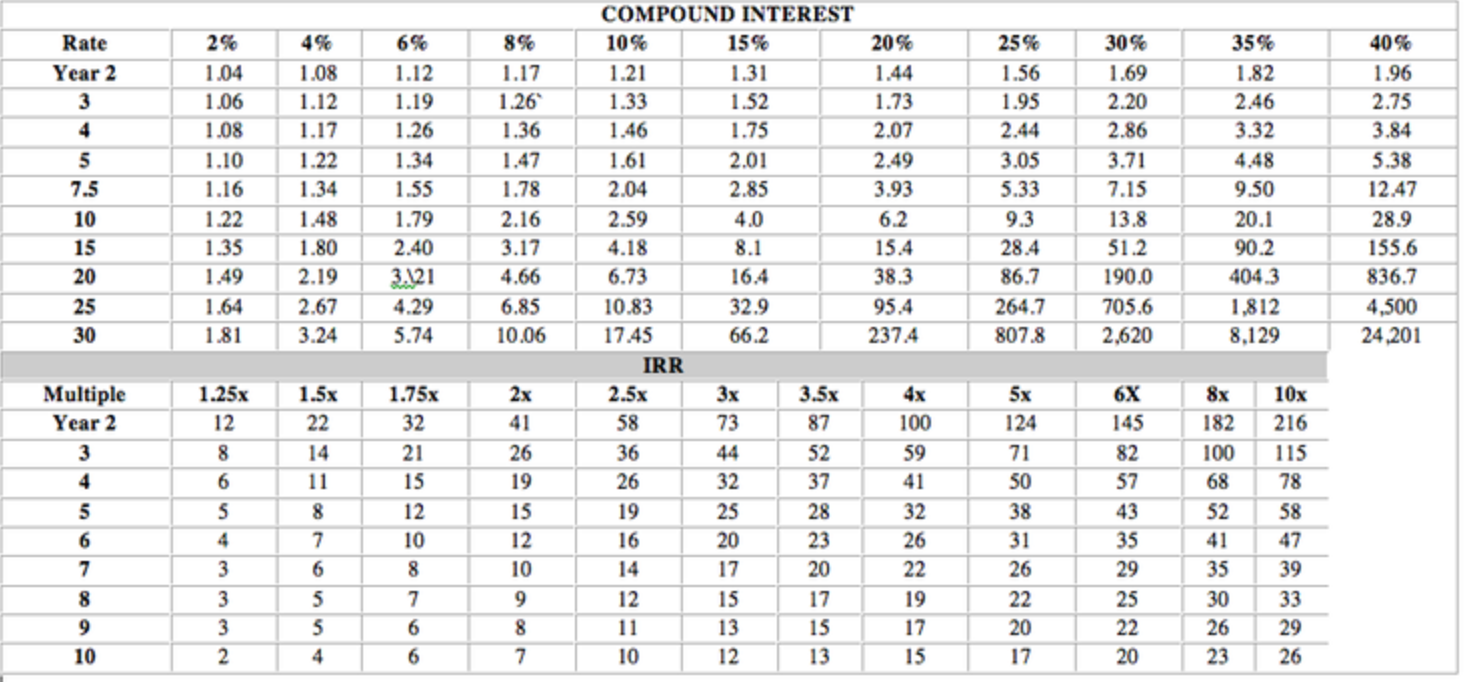

Coller Capital published an IRR card that I used to carry around in my wallet during my first 5 years out of University. It was a business-card sized piece of paper, on one side was a compound interest quick calculator, and on the other was an IRR calculator. I loved that thing, and when I think about compounding I still think of that. My job wasn’t in VC or PE, it wasn’t anything prestigous. I had moved to Kenya to work at a Microfinance company. We didn’t make big deals, but the numbers still worked. At the time though, I had big visions of moving into big finance, where I’d use this card to make big deals.

I lost the card sometime after moving to Cape Town, but I can still recall the hours I would spend trying to memorize the calculations – a waste of time since they had literally made the thing as a cheat sheet so you didn’t need to memorize the numbers. But at that time I was more style than substance, and I thought quick retrieval was important.

The important thing in life though is compound interest. Ben Franklin said that “Money makes money. And the money that money makes, makes money.” He is rumored to have called it the 8th wonder of the world, but I don’t think that list was published back then. Albert Einstein called it the The most powerful force in the universe, and Warren Buffet got rich in part to it.

It governs the world around us, but we don’t really think about it. What is compounding in your life right now? What isn’t?

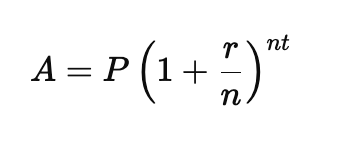

The Formula

Take the principle, and multiply it by the rate over the number of periods, raised to the number of periods multiplied by years. Pretty clear and simple. This formula is actually rarely applied, but intuitively it needs to make sense for the rest to work.

How it is Applied

Venture Capital and Private Equity companies generally think through three types of compounding formulas. The CAGR (Compound Annual Growth Rate), the IRR (Internal Rate of Return), and the MOIC (Multiple of Investment Capital)

CAGR Applied

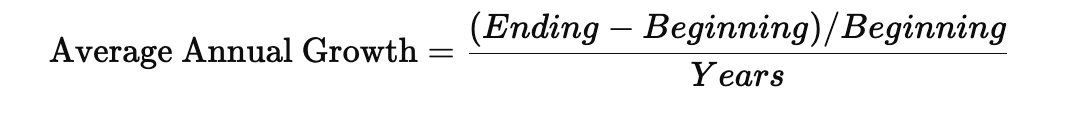

CAGR is used at the company level. It’s a good way to benchmark the return of different projects, or revenue as a firm. I used to always get it confused with a straight line growth. Straight line growth does not take into account compounding! It is a common mistake. Don’t make it. Here is the formla for Straight Line Growth.

The problem with this is that average annual growth diverges enormously from compound annual growth over larger periods of time. Linear averages inflate long-term growth rates. True compounding (CAGR/IRR) is always lower but far more accurate. In VC/PE, misunderstanding this difference can lead to wildly overstated claims of performance.

The core difference is that CAGR captures the real compounding path. It looks at the growth from a current perspective. If my revenue has gone from 100 to 200, this year I am not comparing it to 100, rather to 200. What is the growth on the current principle. That’s what CAGR answers. If you are investing, that’s also exactly what you want to know.

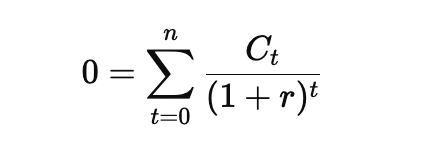

IRR Applied

IRR answers the question: At what annualized compounded rate did this investment grow, given the timing of cash flows? This is nice because it takes into account your initial investment, which is an outflow, along with multiple positive inflows later on. CAGR just takes two values. With IRR, you get a better view of how the investment did over time. Time is the important concept here. IRR is all about the timing of cash flows.

Bigger is better. CAGR is the right lens for a company’s growth. IRR is the right lens for a fund’s cash flows. Both measure compounding, but IRR captures the real-world timing complexity of PE/VC investing.

MOIC Applied

Multiple on Invested Capital is the most straightforward. It answers the question, how much did we make? You take all the money you made, and divide it by all the money you invested. The answer is your MOIC.

The important consideration here is your fee structure. Your management fees will eat the invested capital, and your carry will eat the distributions. So your partner will see a lower MOIC than what the deal actually created.

Compounding is the coolest mathematical concept – it’s a fundamental principle that shapes both financial returns and life outcomes. That IRR card I carried around from Coller Capital has contributed to more wealth than every tech innovation ever created. The invention matters, don’t get me wrong, but it’s the compounding that creates wealth.

I’ve laid out these metrics to help me understand the returns, but also to help me make better decisions. I am learning through writing, and even if I learned all of this before, it’s helpful to write it down. When we grasp how compounding truly works, we see opportunities differently and think more clearly about long-term value creation. The same principles that drive investment returns apply broadly: small advantages, consistently applied over time, can create remarkable outcomes.

So while I no longer carry that compound interest card in my wallet, its lessons remain more valuable than ever. The question isn’t just about financial returns – it’s about identifying and nurturing the compound effects in every aspect of our lives. What is compounding in your life today?

These are high-authority or practical resources you can link out to for credibility and context:

- The Basics of Compound Interest – Investopedia (clear explanation with formulas)

https://www.investopedia.com/terms/c/compoundinterest.asp - Rule of 72 and Doubling Time – Corporate Finance Institute (quick intuition for compounding)

https://corporatefinanceinstitute.com/resources/wealth-management/rule-of-72/ - CAGR Explained – Morningstar (application in finance & investing)

https://www.morningstar.com/investing-definitions/cagr - IRR Definition & Examples – CFA Institute

https://blogs.cfainstitute.org/investor/2020/06/01/internal-rate-of-return-in-private-equity/ - MOIC vs IRR – PitchBook (concise glossary entry comparing the two)

https://pitchbook.com/blog/moic-vs-irr - Fee Impact on Returns – Institutional Limited Partners Association (ILPA Principles)

https://ilpa.org/principles/ - Buffett on Compounding – Berkshire Hathaway Shareholder Letters

https://www.berkshirehathaway.com/letters/letters.html - Ben Franklin on Money & Compound Interest (Letters of Benjamin Franklin)

https://founders.archives.gov/documents/Franklin/01-36-02-0130 - Einstein’s “8th Wonder of the World” Quote (debunked but widely cited) – Quote Investigator

https://quoteinvestigator.com/2011/05/13/einstein-compound-interest/