The FOMO investors must have for unicorns must be excruciating. Missing a deal at seed that scales up to a unicorn would keep me up at nights. Pyschologically, it probably hurts more than having a winner. Yes, you played the game well, but you missed that one shot, that one that would have made you perfect. It takes humility to admit you weren’t as good as someone else. One of the VCs I respect – Fred Wilson – still can’t sound gracious about it all these years later. Bessemer Ventures maintains an anti-portfolio, which tracks all the companies they passed on. I like that.

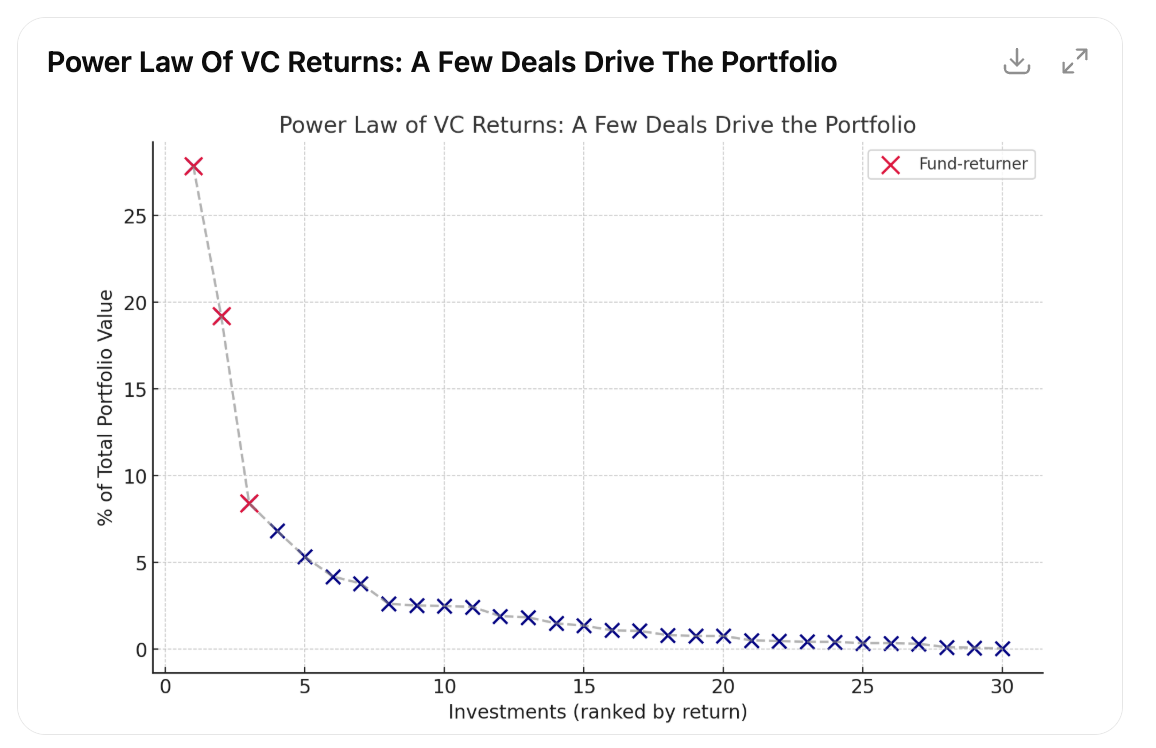

In VC, it’s not series of moderate wins that matter — it’s one outsized success. Below is how I envision it.

Most investments contribute very little to the fund’s performance. It’s just a few that really make the difference. I am curious at what stages it becomes obvious to the VC that a company is going to be the one, vs when it isn’t? And what is the operating playbook once that realization occurs?

Relevant Links

Fred Wilson Talks about USV and Uber

https://www.cnbc.com/2017/05/17/fred-wilson-on-why-usv-did-not-invest-in-uber-at-techonomy-nyc.htmla

Bessemer Anti Portfolio